Intelligent and Customizable Insurance for Modern Travelers with Smart Devices

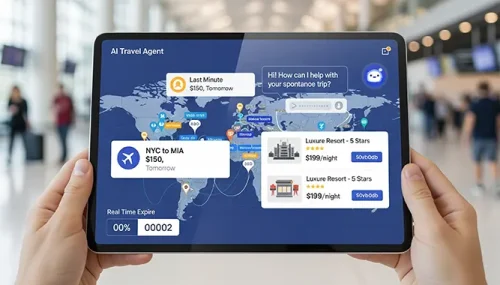

As technology continues to advance, so does the way we travel. Gone are the days of paper maps and guidebooks – today’s modern travelers are equipped with smart devices that provide them with instant access to information, communication, and convenience. Keeping up with this trend, insurance providers have developed intelligent and customizable insurance options specifically tailored to the needs of these tech-savvy adventurers.

Intelligent insurance for modern travelers recognizes the importance of smart devices in our daily lives. These policies not only cover traditional aspects of travel insurance such as trip cancellations, medical emergencies, and lost baggage, but they also offer additional benefits for those who rely on their smartphones, tablets, and smartwatches while on the go.

One of the key advantages of intelligent insurance is the coverage it provides for smart devices. In today’s connected world, losing or damaging a smartphone can be a major inconvenience. With intelligent insurance, …