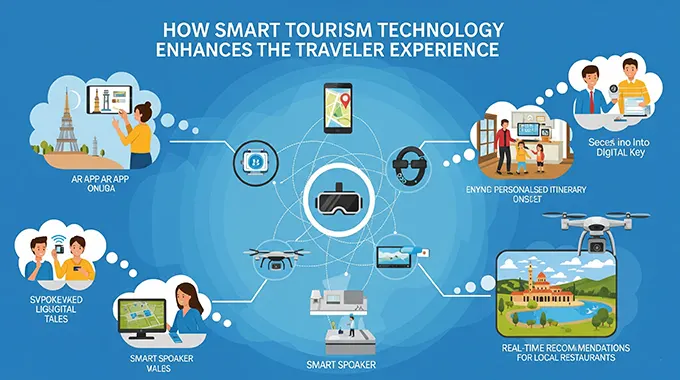

How Smart Tourism Technology Enhances the Traveler Experience

The travel industry has undergone a remarkable transformation, driven by the integration of smart tourism technology. From AI-powered recommendations to immersive augmented reality (AR) experiences, these innovations are reshaping how travelers explore destinations and interact with their surroundings. This article delves into how smart tourism technology enhances the traveler experience, making trips more personalized, efficient, and unforgettable.

Personalized Travel Recommendations

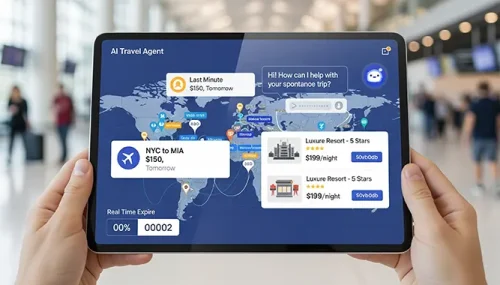

Smart tourism technology leverages artificial intelligence and data analytics to provide tailored travel suggestions. By analyzing preferences, past trips, and real-time data, intelligent platforms recommend destinations, attractions, and activities that align with each traveler’s unique interests. This personalization ensures visitors discover experiences that truly resonate with them, avoiding generic tourist traps.

Seamless Itinerary Planning and Management

With smart apps and platforms, travelers can effortlessly plan, modify, and manage their itineraries. Features like automatic booking confirmations, real-time updates on flight statuses, and notifications about local events help travelers stay informed …